Best Books to Improve Your Financial Literacy

The Best Books to Improve Your Financial Literacy represent more than simple reading; they are blueprints for a wealthier, less-stressed life.

Anúncios

In an economy increasingly dominated by complex financial products and digital currencies, foundational knowledge remains your most valuable asset.

Mastering your personal finances starts with the timeless wisdom found within these pages.

This curated list focuses on the most current, impactful, and enduring titles, ensuring your learning is relevant for the modern financial landscape.

Why is Financial Literacy a Non-Negotiable Skill in 2025?

How Has the Economic Climate Made Financial Knowledge Essential?

Today’s economic volatility, marked by persistent inflation and rapid technological shifts, demands greater personal resilience.

Anúncios

Relying solely on a job or a pension is no longer a viable strategy for many individuals. A solid understanding of money is the only way to safeguard your future. We must actively manage our wealth, not passively hope it grows.

Fintech innovations and the proliferation of accessible investment platforms have created both opportunity and confusion.

Without proper education, these tools become pathways to greater risk, not greater wealth.

The onus falls squarely on the individual to understand the mechanics of compounding, diversification, and debt. Financial literacy is truly a necessity for navigating this complexity.

Simply put, you cannot participate fully in the modern economy without understanding its rules. Financial education provides the necessary intellectual capital to make informed decisions.

It empowers you to move beyond feeling like a victim of circumstance and become a master of your own financial destiny.

++ How to Save Money Without Feeling Restricted

What is the Real-World Impact of Financial Education on Wealth?

Financial knowledge translates directly into measurable economic gains and significantly higher net worth.

Studies consistently demonstrate a strong positive correlation between an individual’s financial literacy and their ability to accumulate wealth. This is not about being a genius; it is about knowing the basics.

For instance, understanding the difference between good debt and bad debt fundamentally changes borrowing habits.

A financially literate person uses low-interest debt to purchase appreciating assets. Their less-informed counterpart frequently uses high-interest credit cards for depreciating consumer goods. The gap widens quickly.

Research utilizing instrumental variables to establish causality demonstrates a powerful link.

The estimated impact of improved financial literacy on household wealth accumulation is substantial, suggesting that investments in financial education yield large wealth payoffs, even beyond the effect of general schooling. This is a clear call to action.

The Foundation Builders: Where Should a Beginner Start Their Reading Journey?

Which Books Demystify the Core Principles of Personal Finance?

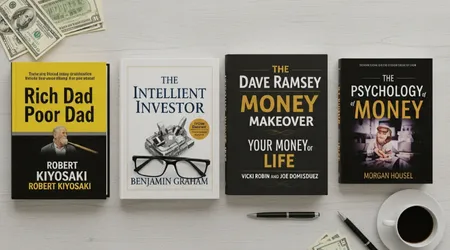

Starting the journey requires books that strip away jargon and focus on behavioral psychology, not just spreadsheets. Morgan Housel’s The Psychology of Money is a modern classic for this reason.

It brilliantly argues that your behavior, more than your intellect, determines your financial success. This book shifts the mindset from what to do to how to think.

Another essential foundational text is The Simple Path to Wealth by J.L. Collins. This book offers a refreshingly direct, no-nonsense roadmap to financial independence.

It champions simple, low-cost index fund investing as the most effective path for the majority of people. Collins’s advice is incredibly actionable and easy to implement immediately.

A third vital entry is Ramit Sethi’s I Will Teach You to Be Rich. This guide takes a practical, six-week approach to automating your finances.

Sethi focuses on big wins like negotiating large salaries or optimizing banking fees rather than obsessing over small sacrifices. It’s a powerful book for taking control through systematic setup.

Also read: Common Money Mistakes Young Professionals Make

How Do the Classics Still Offer Relevant Wisdom Today?

Timeless books endure because human nature and the fundamental rules of money rarely change. George S. Clason’s The Richest Man in Babylon, though written in 1926, remains remarkably relevant.

Its parables distill complex principles like saving at least ten percent and paying yourself first into easily digestible stories.

Another cornerstone is Benjamin Graham’s The Intelligent Investor, famously championed by Warren Buffett.

While more complex, it teaches the critical difference between speculation and investing.

Graham’s principles of value investing provide a crucial shield against market irrationality and panic selling. Every serious investor eventually needs to grasp Graham’s teachings.

These foundational works equip you with an iron-clad emotional and intellectual framework. They demonstrate that financial success isn’t luck; it’s the result of consistent application of simple, common-sense principles.

Skipping these classics is like trying to build a house without a strong foundation.

Investing and Wealth Building: Moving Beyond Basic Budgeting

What Are the Best Books to Improve Your Financial Literacy Regarding Investment Strategy?

Once basic budgeting is mastered, the focus must shift to maximizing capital growth through intelligent investing.

Burton Malkiel’s A Random Walk Down Wall Street makes a compelling, evidence-based case for passive investing over trying to beat the market.

He argues that a strategy of buying and holding diversified, low-cost index funds outperforms most active managers.

For a deeper dive into behavioral economics influencing investment, consider Nobel laureate Richard Thaler’s works. His insights explain the irrational, emotional drivers behind market bubbles and crashes.

Understanding these cognitive biases prevents you from making costly, fear-driven mistakes. Thaler helps you see the market for what it is: a collection of emotional humans.

These books challenge the common belief that investing is a high-risk, high-reward casino game. Instead, they present it as a long-term, deliberate process rooted in statistical probabilities and discipline.

They encourage patience, consistency, and a skeptical eye toward sensational financial news.

Read more: Beginner’s Guide to Building Your Emergency Fund in a Volatile Economy

Why is Understanding Financial Psychology More Important Than Market Knowledge?

Think of financial literacy as driving a car. Basic literacy (budgeting, saving) is knowing how to turn the key and shift gears. Investment knowledge (Graham, Malkiel) is understanding the engine mechanics.

Financial psychology (Housel) is about realizing that your emotional state in traffic, not the car’s power, usually causes accidents.

Your greatest enemy in the financial markets is often yourself: the fear when stocks drop, or the greed when they soar.

The Psychology of Money underscores this idea. It shows that people with only average knowledge but excellent emotional temperament often outperform highly educated but emotionally volatile investors. This is a powerful, humbling lesson.

Books focusing on psychology teach you to stick to a long-term plan, ignoring the daily noise of the markets. Can you remain calm when the news predicts a crash?

That emotional discipline is the key difference between a successful investor and a perennial market victim. This behavioral edge is priceless.

Table of Must-Read Financial Literacy Books

| Book Title | Author(s) | Key Lesson Focus | Primary Target Audience |

| The Psychology of Money | Morgan Housel | Behavioral Finance, Mindset | All Readers (Essential Start) |

| The Simple Path to Wealth | J.L. Collins | Low-Cost Index Investing, FI | Beginners to Intermediate |

| I Will Teach You to Be Rich | Ramit Sethi | Automation, Big Wins, Debt | Young Adults, Debt-Focused |

| The Millionaire Next Door | Stanley & Danko | Frugality, Wealth Profiles | Aspiring High Net Worth |

| A Random Walk Down Wall Street | Burton G. Malkiel | Passive Investing, Market Efficiency | Investment Beginners |

Overcoming the Debt Trap with Reading

Sarah, 30, was drowning in $25,000 of high-interest credit card debt. She felt paralyzed by the monthly interest.

After reading a chapter on the “Debt Snowball” method in The Total Money Makeover, she gained a clear, aggressive plan.

She focused on the smallest debt first, using the psychological win to fuel her attack on the larger balances.

This one strategy, learned from one of the Best Books to Improve Your Financial Literacy, shifted her from despair to action, achieving debt-freedom within two years.

The Power of Index Fund Investing

Mark, 45, was consistently trying to pick “hot stocks,” often losing money on speculative bets. His portfolio was stagnant.

He read The Simple Path to Wealth, internalizing the concept that “fees matter.” He sold his actively managed mutual funds and high-risk stocks, shifting all his new savings into a single, low-cost global index fund.

Over the next decade, his portfolio began compounding consistently, requiring almost zero maintenance or worry, proving the simplicity of index funds.

Conclusion: The Ultimate Investment in Yourself

Choosing the Best Books to Improve Your Financial Literacy is the most significant financial decision you can make this year.

These books are not get-rich-quick schemes; they are time-tested guides to sustained prosperity and independence.

They teach you to control your money, preventing your money from controlling you. Financial freedom is an outcome of intentional learning and consistent behavior, not luck.

The path to financial confidence is paved with pages. Make the commitment now to read and internalize this foundational knowledge. The reward is a lifetime of informed decision-making and a greater sense of security.

Which book on this list will you start reading tonight? Share your choice and your current biggest financial goal in the comments below!

Frequently Asked Questions (FAQ)

Are these older books still relevant given the rise of cryptocurrency and AI in finance?

Absolutely. While the financial tools change (e.g., crypto, AI trading), the fundamental human behaviors of fear, greed, and the basic principles of compounding and risk management remain the same.

The principles taught in these books like saving first and keeping costs low are more crucial than ever in a complex, volatile digital market.

Is there a specific order I should read these books in?

Yes, a good sequence helps. Start with the behavioral foundation: The Psychology of Money. Then move to practical implementation like budgeting and debt: I Will Teach You to Be Rich or The Total Money Makeover.

Finally, dive into the investment strategy: The Simple Path to Wealth or A Random Walk Down Wall Street.

I have a lot of debt. Which book should I prioritize?

If high-interest debt is your most pressing issue, prioritize books with actionable, step-by-step debt elimination plans.

Both Dave Ramsey’s The Total Money Makeover and Ramit Sethi’s I Will Teach You to Be Rich provide aggressive, structured approaches to tackle consumer debt effectively.

Do I need to be good at math to understand these financial literacy books?

No, you certainly do not! Most of the Best Books to Improve Your Financial Literacy deliberately avoid complex mathematics.

They focus on common sense, simple arithmetic, and behavioral strategies. Concepts like compounding are explained clearly, using relatable examples rather than calculus.

Why do many lists of the Best Books to Improve Your Financial Literacy recommend index funds?

Financial experts recommend index funds because they offer immediate diversification, very low fees, and historically, have consistently outperformed the majority of actively managed funds over the long term.

This simplicity minimizes risk and maximizes long-term returns, making it the most sensible choice for most people.